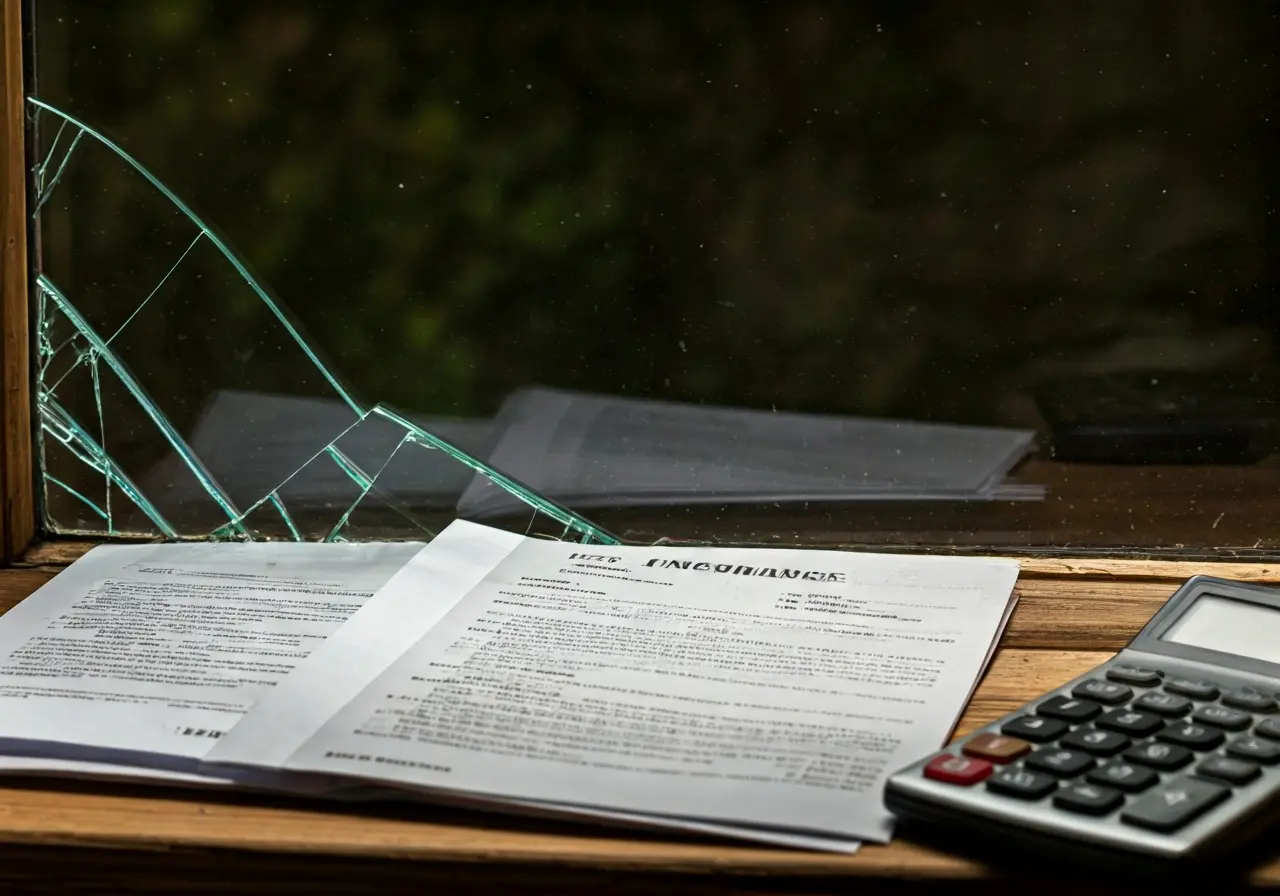

Dealing with property damage can be overwhelming, especially when trying to navigate insurance claims. Hiring an insurance claim consultant can make the process smoother and less stressful. In this blog, we’ll explore how these professionals can help you handle your property damage claims effectively.

Understanding the Role of an Insurance Claim Consultant

An insurance claim consultant acts as a liaison between you and the insurance company. Their expertise in insurance policies and claims processes ensures that your claim is managed efficiently. They guide you through the complexities of filing a claim and help maximize your insurance benefits.

The nuances of insurance policies can often be baffling. You might find yourself bogged down by legal jargon and procedural red tape. This is where the expertise of an insurance claim consultant becomes invaluable. They meticulously dissect the fine print and uncover hidden provisions that could be pivotal for your claim. By doing so, they arm you with all the necessary information to confidently navigate the claims process and negotiate effectively with your insurance provider.

Consultants not only bring their knowledge but also a wealth of experience. They are well-versed with various types of property damages and understand how different factors can influence the outcome of a claim. For instance, their understanding of weather-related damage, like hurricanes or floods, can help you present your case in the most compelling manner. With their help, you can rest assured that your insurance claim is in capable hands.

When to Consider Hiring a Consultant

If you’re dealing with extensive property damage or a complex insurance policy, it might be time to consult an expert. Consultants are especially helpful when your claim has been denied or undervalued. They have the skills to reassess and negotiate with insurers to reach a fair settlement.

Navigating your options can often be the most challenging part of the claims process. If your insurer is offering you less than what you anticipated, or if your property damage involves multiple facets, this is a prime situation where a consultant could be beneficial. Their specialized knowledge allows them to identify discrepancies and ensure you receive the compensation you rightfully deserve.

Involving a consultant when facing disputes with your insurer can lead to a more favorable outcome. These professionals can identify overlooked details that could affect the valuation of your claim. With their negotiation skills, they serve as your advocate, fighting for what is fair and just on your behalf.

Moreover, when an insurer’s settlement does not align with your expectations, a consultant can step in to re-evaluate the damages comprehensively. They rely on their profound understanding of property valuations and loss assessments to put forth a strong case. This strategic insight often translates into recovering a much higher settlement, one that truly reflects the extent of your loss.

Preparing for Your Consultation

Before meeting with a consultant, gather all relevant documentation, including photos of the damage, insurance policies, and previous correspondence with the insurance company. Being prepared helps the consultant understand your situation better and streamline the claims process.

Having a structured set of documents is not merely about ticking boxes—it’s about laying the groundwork for a successful claim. Important evidence such as receipts, estimates for repair costs, and any communication records with your insurer creates a comprehensive narrative of your situation. This preparation gives your consultant the upper hand to make a compelling case instantly.

Providing detailed information facilitates the consultancy process and minimizes undue delays. A well-documented claim can reveal significant points that can be leveraged during negotiations. Consider adding a descriptive timeline of events leading up to the damage, as it offers consultants a clear view and assists in formulating a strategy tailored to your claim.

The Benefits of Professional Representation

Hiring a consultant can save you time, reduce stress, and ensure you’re adequately compensated for your loss. With their knowledge and experience, they handle negotiations, paperwork, and follow-ups, allowing you to focus on recovery and rebuilding.

The invaluable support from a consultant ensures not only the completeness of your documentation but also accentuates the negotiation process. Their proficiency in handling insurance disputes leads to a quicker resolution. By effectively managing interactions with insurance adjusters, consultants alleviate the pressure from policyholders, allowing them peace of mind in an otherwise stressful situation.

Choosing an insurance claim consultant means choosing someone who is in your corner. Their obligation is to persevere through the quirks of insurance procedures while keeping your best interests at heart. Their ultimate goal is securing an outcome that aligns with your expectations, making them an essential ally in your claims journey.

Rely on consultants to bring clarity to confusing policy terms and conditions. By breaking information down into identifiable chunks, they bridge the gap between you and the labyrinth of insurance policies. Let them be your spokesperson, dealing with bureaucracies while you regain control of your property and your life.

Simplify Your Claims with Professional Guidance

Navigating property damage claims can be daunting, but an insurance claim consultant can provide the expertise and support you need. By understanding the claims process, preparing comprehensive documentation, and advocating on your behalf, these consultants can significantly increase your chances of a successful claim. Don’t hesitate to reach out to a professional to guide you through this often complex journey.