Dealing with mold in your home or business can be stressful, and understanding how mold remediation services work with your insurance can add to that stress. This guide will help you navigate the process, from identifying the problem to getting the coverage you need.

Identifying the Need for Mold Remediation

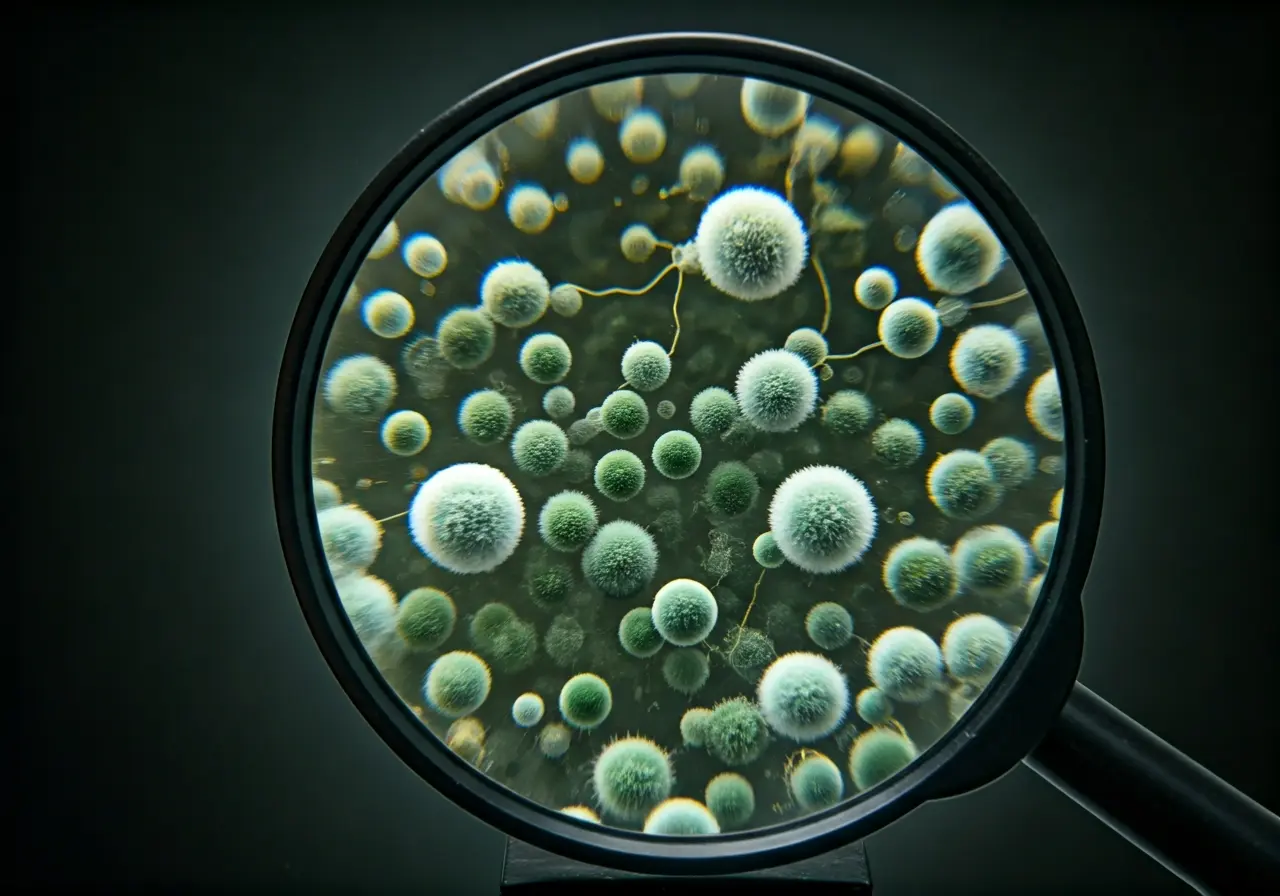

Mold growth is more than just an eyesore; it can have significant health impacts and damage the structural integrity of your property. Recognizing the signs early on can save you money and hassle in the long run. Mold often appears as black, green, or white patches on surfaces in damp, poorly ventilated areas of a home, such as basements, bathrooms, and kitchens. Sometimes, the first sign of mold is a musty odor indicating hidden growth behind walls or under floors.

One of the biggest health concerns with mold is its potential to cause respiratory problems, allergies, and even more severe health issues in individuals with compromised immune systems. The CDC notes that exposure to damp and moldy environments may cause various symptoms in otherwise healthy people, including nasal stuffiness, throat irritation, coughing, or skin irritation.

It’s essential to conduct regular checks, especially in areas prone to moisture. If you do spot mold, it’s important to act swiftly. Mold not only affects health but can also lead to significant damage to buildings by weakening walls and ceilings over time. Early detection can lead to simpler and less costly remediation efforts.

Understanding How Mold Remediation Services Work

Mold remediation is a comprehensive process designed to help ensure your home or business returns to a safe environment. It generally begins with a detailed inspection and assessment by a certified professional to determine the extent and type of mold present. One beneficial step offered by many services is environmental testing to identify hidden mold problems that are not visible to the naked eye.

After the initial assessment, containment measures are put in place to prevent the spread of mold spores during the cleanup process. This usually includes sealing off the affected area and using air filtration devices to capture spores in the air. Once contained, the technicians will remove mold-infested materials, sanitize the space, and apply treatments to prevent future growth. Interested in learning about our service approaches, you can explore more details here.

Professional remediation services are equipped to handle mold more effectively than DIY approaches. For extensive infestations, careful and methodical cleaning is necessary to ensure no lingering spores are missed. This is why a reputable service provider is key—they’ll not only address the immediate problem but also advise on reducing moisture in your home and improving overall air quality to prevent recurrence.

Insurance Coverage for Mold Remediation

Insurance coverage for mold can range widely depending on your policy and the circumstances leading to mold development. Generally, standard homeowner’s insurance policies do not cover mold damage, except under specific conditions. For instance, if mold results from a covered peril, such as a burst pipe, the remediation might be eligible for insurance coverage.

Before assuming coverage, it’s critical to review your individual policy details and consult your insurance provider. Some policies offer limited mold coverage, while others may require additional endorsements or riders. To ease the claims process, ensure you document the mold damage thoroughly with photographs and detailed notes.

If your policy does not cover mold damage, consider mitigating the cost by exploring preventive measures. Insurance experts often advise on adding mold protection options well before any issues arise, which can save a lot on future repairs. For detailed inquiries about insurance handling, our expert assistance is always available.

Common Challenges in the Claims Process

Even when mold coverage exists, the claims process isn’t always straightforward. One common challenge is proving that mold was caused by a covered peril rather than neglect, which can significantly affect the claim outcome. To support your case, it’s often beneficial to have a professional assessment report indicating the cause and extent of mold damage.

Partial coverage issues also arise if post-policy changes affect your eligibility. Some policyholders find themselves paying out-of-pocket due to misunderstandings about policy limits or exclusions related to mold damage. Staying informed and consulting with your insurance provider regularly help keep your policy in line with current needs and conditions.

Don’t hesitate to seek the help of professional public adjusters if you find navigating the claims process overwhelming. They can help present your case more effectively and negotiate with insurance companies on your behalf, potentially leading to better compensatory outcomes. Knowing these possible hurdles can arm you with confidence as you approach insurance claims.

How to Choose the Right Mold Remediation Service

Finding a trustworthy and competent mold remediation service can make a significant difference in how quickly and effectively your home is restored to a safe condition. One critical aspect to consider is whether the company employs certified Mold Remediation Specialists who follow industry-standard processes.

It’s always a good idea to check reviews and ratings from previous clients to gauge a company’s reputation. A high level of customer satisfaction and positive feedback can give confidence in your choice. Many reputable services also offer emergency responses and warranties on their work, ensuring quality cleanup and peace of mind.

Cost can vary widely, so obtaining several quotes can provide a benchmark for expected expenses. However, remember that choosing the cheapest service isn’t always the safest bet. The highest quality services often balance competitive pricing and long-term efficacy in their mold removal solutions.

Navigating Mold Remediation and Insurance with Confidence

Understanding the ins and outs of mold remediation services and insurance can seem daunting, but with the right knowledge, you can approach the situation confidently. Remember to communicate openly with your insurance provider and remediation service to ensure a smooth process.