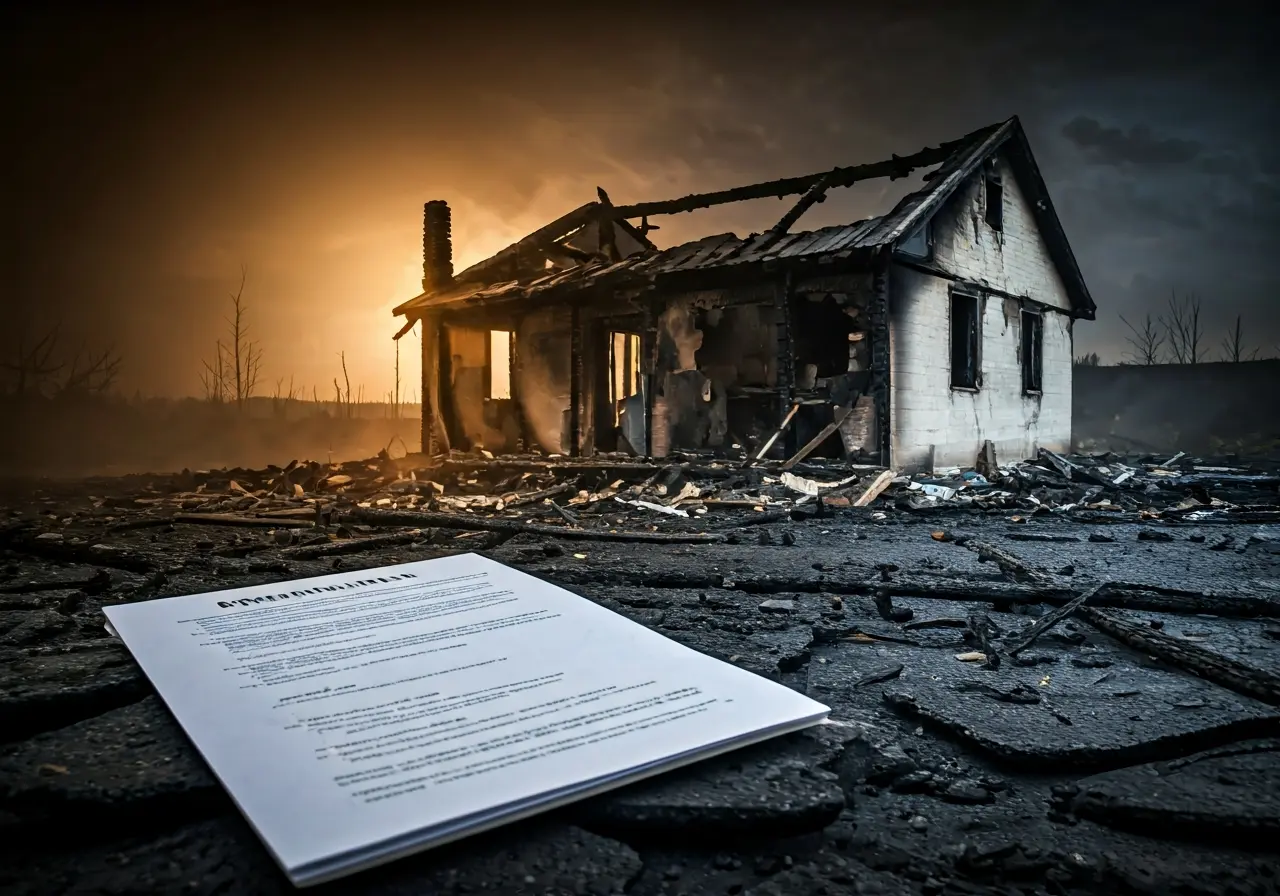

Experiencing fire damage in your home or business can be overwhelming. With so much on your plate, from salvaging belongings to ensuring safety, dealing with insurance claims can seem daunting. This is where hiring a fire insurance adjuster can make a significant difference.

Understanding the Role of a Fire Insurance Adjuster

A fire insurance adjuster is a professional who works on your behalf to assess fire damage and manage the claims process with your insurance company. Their expertise ensures that all aspects of the damage are accurately evaluated.

By engaging a fire insurance adjuster, you’re investing in a smoother claims process. These professionals are adept at documenting losses, which can be a tedious task, especially when dealing with extensive damage. Their experience in handling numerous claims allows them to navigate through complex bureaucracies effectively.

An adjuster also plays an advisory role, guiding policyholders through intricate policy details that may not be apparent at first glance. This professional insight can be crucial in ensuring that you understand your entitlements and what steps to take next.

Evaluating the Scope of Fire Damage

Fire damage can be extensive and not always obvious. An adjuster thoroughly inspects the property, identifying hidden damage, and providing a comprehensive report that aids in proper claim filing.

The aftermath of a fire may seem straightforward, but damages can lurk beneath the surface. Smoke and soot permeate walls, insulation, and ductwork, leading to long-term structural issues if unaddressed. An experienced adjuster meticulously evaluates these hidden dangers, safeguarding your long-term interests.

In addition to visible destruction, fires can also affect electrical systems and infrastructure. Adjusters assess these areas meticulously, ensuring that no stone is left unturned in your damage evaluation report.

Navigating the Complexities of Insurance Policies

Insurance policies can be complex and filled with fine print. A fire insurance adjuster helps interpret these policies, ensuring you understand your coverage and aids in maximizing your claim benefits.

Insurance jargon can be bewildering, but you don’t have to tackle it alone. Adjusters have the experience to dismantle these complex terms and present your policy in layman’s terms. This clarity empowers you to make informed decisions about your claims.

Moreover, policies often include coverage limits, exclusions, and specific deductibles unknown to many policyholders. Adjusters highlight these critical details, so you are fully aware of your coverage scope.

Ensuring Accurate and Fair Claim Settlements

Adjusters act as your advocate during settlement negotiations with the insurance company, using their expertise to secure a fair and accurate settlement for your fire damage claim.

Without professional guidance, settling a claim can result in lower compensation than deserved. Adjusters prioritize ensuring that every legitimate expense and damage aspect is acknowledged, leading to a settlement that truly reflects the incurred losses.

Their negotiation expertise cannot be overstated. With knowledge of industry standards and practices, adjusters are critical in countering lowball offers, thus preventing insurance companies from skimping on rightful reimbursements.

Saving Time and Reducing Stress

Handling claim paperwork and back-and-forth with insurance companies is time-consuming. By hiring an adjuster, you can focus on restoration and recovery instead of navigating tedious administrative tasks.

The administrative load following a fire is substantial. Gathering documents, answering queries, and negotiating figures require time and energy that are better spent elsewhere during recovery. An adjuster takes this burden off your shoulders, allowing you to prioritize your mental and emotional healing.

Furthermore, adjusters streamline communication between all involved parties, ensuring a smooth flow of information. This seamless network reduces potential miscommunications and speeds up the claim process, resulting in less anxiety for you.

The Key Role of a Fire Insurance Adjuster

Navigating the aftermath of a fire can be stressful and confusing, but a fire insurance adjuster can help ease your burden. They bring expertise, support, and negotiation skills to the table, ensuring you receive the compensation you deserve. By hiring a professional, you can focus on rebuilding and recovery with peace of mind.